For the original policy text, please refer to the bottom of the article.

Overview

This is an official announcement from China's Ministry of Finance, State Taxation Administration, and Ministry of Commerce, issued on June 27, 2025, establishing a tax credit policy for overseas investors who reinvest distributed profits in China.

Key Policy Details

Tax Credit Benefits

Credit Amount: 10% of the investment amount

Effective Period: January 1, 2025 to December 31, 2028

Usage: Can offset current year tax payable; unused portions carry forward to subsequent years

Treaty Rate: If applicable tax treaty rate is lower than 10%, the treaty rate applies

Comparison of Reinvestment Tax Incentives: Then vs. Now

Under the old policy, overseas investors could defer withholding tax (10%) on reinvested dividends, postponing payment until events like asset transfer or liquidation, without reducing the tax liability.

The new policy adds a permanent tax credit (10% of reinvested amount), improving after-tax returns and accessibility for long-term investors. Now, overseas investors benefit from both tax deferral and a tax credit, enhancing reinvestment returns and policy appeal.

Qualifying Conditions

To be eligible, overseas investors must meet ALL of the following:

Profit Source: Use dividends or equity investment income from retained earnings of domestic Chinese enterprises

Investment Types: Direct investments including:

Capital increases in domestic enterprises

Greenfield investments (establishing new enterprises)

Equity acquisitions from unrelated parties

Excludes: Listed company share purchases (except strategic investments)

Industry Requirement: Invested enterprise must operate in nationally encouraged industries per the Catalog of Encouraged Industries for Foreign Investment

Holding Period: Minimum 5 years (60 months) consecutive investment maintenance

Payment Method: Direct cash transfers or asset transfers without intermediary accounts

Tax Offset Mechanism

Applies to enterprise income tax (EIT) on dividends, interest, royalties, and other income from the profit-distributing enterprise

Profit-distributing enterprises can temporarily refrain from withholding EIT on reinvestment profits

Investment Recovery Rules

After 5+ years: Pay deferred taxes within 7 days; unused tax credits can carry forward

Before 5 years: Pay deferred taxes + proportional reduction in tax credits + repay excess credits used

Administrative Process

Invested enterprises submit information via Ministry of Commerce's online platform

Local commerce authorities review and forward to provincial level

Provincial authorities confirm eligibility with finance/tax authorities

Issue Profit Reinvestment Information Form with unique national code

Quarterly reporting to relevant authorities

Special Provisions

Corporate Restructuring: Tax credit continues if restructuring qualifies as "special restructuring"

Monitoring: Authorities will monitor compliance and recover underpaid taxes if conditions not met

Retroactive Application: Available for qualifying investments made between January 1, 2025 and announcement date

Post-2028: Remaining tax credit balances can continue to offset taxes until exhausted

Definitions

Overseas Investor: Non-resident enterprise per Enterprise Income Tax Law

Domestic Resident Enterprise: Resident enterprise legally established in China

This policy aims to encourage foreign investment reinvestment in China by providing significant tax incentives while ensuring compliance with strict eligibility and reporting requirements.

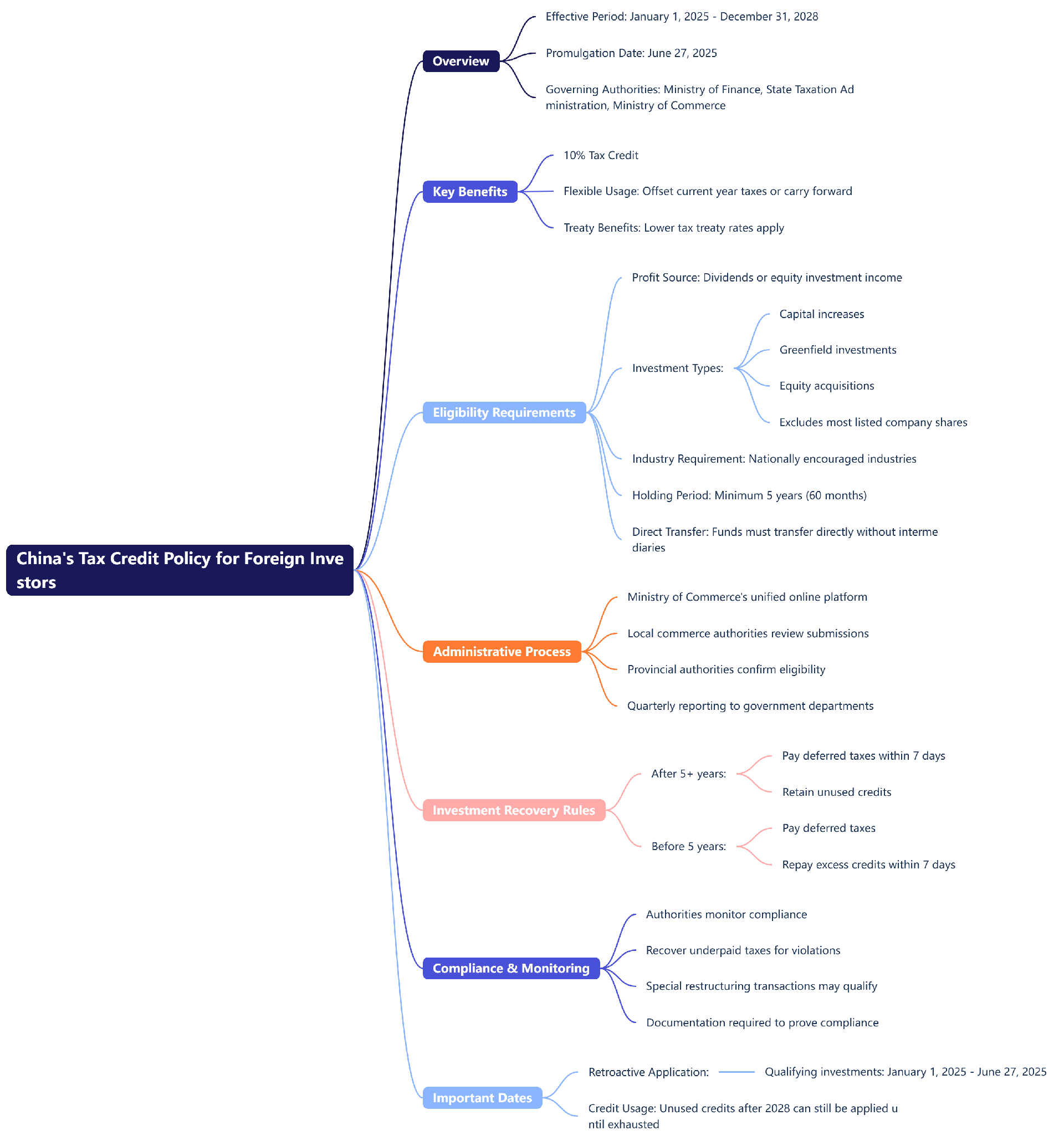

Mind Map

Announcement on the Tax Credit Policy for Foreign Investors Making Direct Investment with Distributed Profits

Announcement of the Ministry of Finance, the State Taxation Administration, and the Ministry of Commerce [2025] No. 2

June 27, 2025

To order to implement the decisions and directives of the CPC Central Committee and the State Council, and pursuant to the Law on Enterprise Income Tax and its implementation regulations, the tax preferential policy for overseas investors making direct investment with distributed profits is hereby announced as follows:

1. From January 1, 2025 to December 31, 2028, overseas investors that make qualified direct investments within China using profits distributed by domestic resident enterprises may apply for a tax credit equal to 10% of the investment amount, which may be offset against their tax payable for the current year, and any unused portion of the tax credit may be carried forward to subsequent years. Where the applicable tax rate for dividends or other equity investment income under a tax treaty between the People’s Republic of China and the relevant foreign government is lower than 10%, the treaty rate shall apply.

II. The term "overseas investors that makes qualified direct investments within China using profits distributed by domestic resident enterprises" refers to those meeting all of the following conditions:

(I) The profits distributed are dividends or other equity investment income derived from retained earnings actually distributed by the domestic resident enterprise to the overseas investor;

(II) The distributed profits are used for direct investments within China, including capital increases, greenfield investments, equity acquisitions, or other forms of equity investment made using the distributed profits, excluding the acquisition, increase (from capital reserve conversion), or purchase of shares of listed companies (except where such purchases qualify as strategic investments). Specifically, this includes:

1. Increasing the paid-in capital or capital reserves of a domestic resident enterprise through new contributions or capital conversion,

2. Investing in the establishment of a new domestic resident enterprise within China; or

3. Acquiring equity in a domestic resident enterprise within China from an unrelated party.

Resident enterprises invested in through the above-mentioned methods by overseas investors are hereinafter collectively referred to as “invested enterprises.”

(III) During the period of reinvestment in China by the overseas investor, the industry in which the invested enterprise operates shall fall within the scope of nationally encouraged industries for foreign investment, as listed in the Catalog of Encouraged Industries for Foreign Investment.

(IV) The overseas investor must maintain the reinvestment in China for a minimum consecutive period of five years (60 months).

(V) The profits used by the overseas investor for direct investment in China shall be paid in cash, with the relevant funds transferred directly from the profit-distributing enterprise’s account to the account of the invested enterprise or equity transferor, without being circulated through any other domestic or foreign accounts prior to such direct investment; if the profits used by the overseas investor for direct investment in China are paid in kind or through non-cash means such as securities, ownership of the relevant assets shall be transferred directly from the profit-distributing enterprise to the account of the invested enterprise or equity transferor, without being held or temporarily held by any other enterprises or individuals prior to the direct investment.

III. The term “tax payable” that may be offset by overseas investors refers to the enterprise income tax (EIT) payable on income-such as dividends, interest, royalties, and other types of income-derived by the overseas investor from the profit-distributing enterprise after the date on which such profits are reinvested, as prescribed by Paragraph 3, Article 3 of the Enterprise Income Tax Law.

IV. Overseas investors meeting the conditions set forth in this Announcement shall, in accordance with tax administration requirements, provide the profit-distributing enterprise with documentation proving compliance with the relevant policy conditions. Based on the provided documentation, the profit-distributing enterprise may temporarily refrain from withholding EIT, as required by Article 37 of the Law on Enterprise Income Tax, on the profits intended for reinvestment, and when paying dividends, interest, royalties, or other types of income as prescribed in the third Paragraph 3, Article 3 of the Law on Enterprise Income Tax to the overseas investor, may apply to the competent tax authority for an offset against the EIT payable by the overseas investor.

V. Where an overseas investor recovers part or all of a direct investment that has benefited from the tax credit policy after maintaining the investment for five years (60 months) or more, the investor shall, within seven days of the recovery, declare and pay the deferred taxes on the portion of profits distributed by the domestic resident enterprise that corresponds to the recovered investment to the local tax authority where the profit-distributing enterprise is located, and any unused balance of the tax credit for the reinvestment may be carried forward to offset the investor’s EIT payable.

Where an overseas investor recovers part or all of a direct investment that has benefited from the tax credit policy after maintaining it for less than five years (60 months), the portion of profits distributed by the domestic resident enterprise corresponding to the recovered investment shall be deemed not to have met the tax preferential conditions set forth in this Announcement. In such cases, in addition to paying the deferred taxes in accordance with the preceding paragraph, the eligible tax credit amount for the overseas investor shall be proportionally reduced. If the amount of tax credit already used exceeds the adjusted eligible amount, the overseas investor shall repay the excess portion within seven days of recovering the investment.

Where the recovered direct investment includes portions that have and have not benefited from the tax credit policy, the portion that has benefited shall be deemed to have been recovered first.

VI. For overseas investors that meet the conditions set forth in this Announcement, the invested enterprise shall, through the Ministry of Commerce’s unified online service system platform (Integrated Management Application for Foreign Investment), submit, to the local commerce authority, information including: the name and nationality of the overseas investor; the names and locations of both the invested enterprise and the profit-distributing enterprise; and the date, industry sector, and amount of the reinvestment, along with relevant certificates. The local commerce authority where the invested enterprise is located shall review and verify the submitted information and forward it to the competent provincial-level commerce authority. The provincial commerce authority shall confirm the investor’s eligibility in conjunction with the finance, tax, and other relevant authorities at the corresponding level, and issue a Profit Reinvestment Information Form with a unique national code, among other materials, to the invested enterprise. The invested enterprise shall then provide the relevant materials to the overseas investor. The provincial-level commerce authority shall compile the information and, within fifteen days after the end of the current quarter, provide it to the finance and tax authorities at the corresponding level, as well as report it to the Ministry of Commerce.

Where an overseas investor that has benefited from the tax credit policy recovers their investment, the invested enterprise shall, through the Ministry of Commerce’s unified online service system platform (Integrated Management Application for Foreign Investment), submit, to the local commerce authority, information including: the name and nationality of the overseas investor; the names and locations of both the invested enterprise and the profit-distributing enterprise; and the date, industry sector, and amount of the recovered investment. The local commerce authority where the invested enterprise is located shall review and verify the submitted information and forward it to the competent provincial-level commerce authority for confirmation. The provincial-level commerce authority shall compile the above information and, within fifteen days after the end of the current quarter, provide it to the finance and tax authorities at the corresponding level and report it to the Ministry of Commerce.

VII. Where, after an overseas investor has benefited from the tax credit policy under this Announcement, the invested enterprise undergoes a restructuring that qualifies as a special restructuring and is treated as a special restructuring for tax purposes, the overseas investor may continue to enjoy the tax credit policy.

VIII. Commerce authorities at all levels shall, in conjunction with relevant authorities, strengthen the monitoring and administration of reinvestments made by overseas investors using distributed profits and, upon discovering, in the course of subsequent administration, non-compliance with the prescribed conditions by an overseas investor that has benefited from the tax credit policy, shall promptly notify the tax authorities of the matter and assist in recovering any underpaid taxes, with the deferral period calculated from the date the investor benefited from the policy.

IX. For the purposes of this Announcement, the term "overseas investor" refers to a non-resident enterprise as prescribed in Paragraph 3, Article 3 of the Law on Enterprise Income Tax; the term "domestic resident enterprises" refers to a resident enterprise legally established within China.

X. This Announcement shall be effective from January 1, 2025, to December 31, 2028. Overseas investors that still hold a remaining tax credit balance after December 31, 2028, may continue to apply such balance to offset applicable taxes until the balance is zero. From the date of issuance of this Announcement, overseas investors that have made investments meeting the conditions set forth herein between January 1, 2025 and the date of issuance may apply for retrospective application of the tax credit policy, and the corresponding tax credit amount may be used to offset the tax payable as provided in Article 3 of this Announcement, provided such tax liability arises after the date of issuance; investments made prior to January 1, 2025, shall not be eligible for retrospective application of this policy.

This is hereby announced.