How China Collects Tax on Offshore Indirect Share Transfer

Like most of other countries, China Enterprise Income Tax Law ("EIT Law") imposes EIT (10%) on the gains derived by nonresident shareholders from the direct share transfer of China resident enterprises.

From 1 January 2008, if an offshore indirect share transfer of China resident enterprises is conducted without a bona fide commercial purpose, it may be also taxed by Chinese tax authorities under the "anti-tax avoidance" rule, according to the “Notice on Strengthening the Administration of EIT Concerning Equity Transfer for Nonresident Enterprises”, Guo Shui Han [2009] No. 698 (“Circular 698”).

On 6 February 2015, Announcement [2015] No. 7 (“Announcement 7”) was issued to replace Circular 698, which provides more certainty for compliance with the China indirect share transfer rules for nonresident shareholders. And the applicable scope of Announcement 7 is expanded from indirect share transfer to indirect transfer of China taxable assets, including shares in Chinese resident enterprises, immovable properties located in China and assets attributable to an establishment in China.

1. Simple example of offshore indirect share transfer

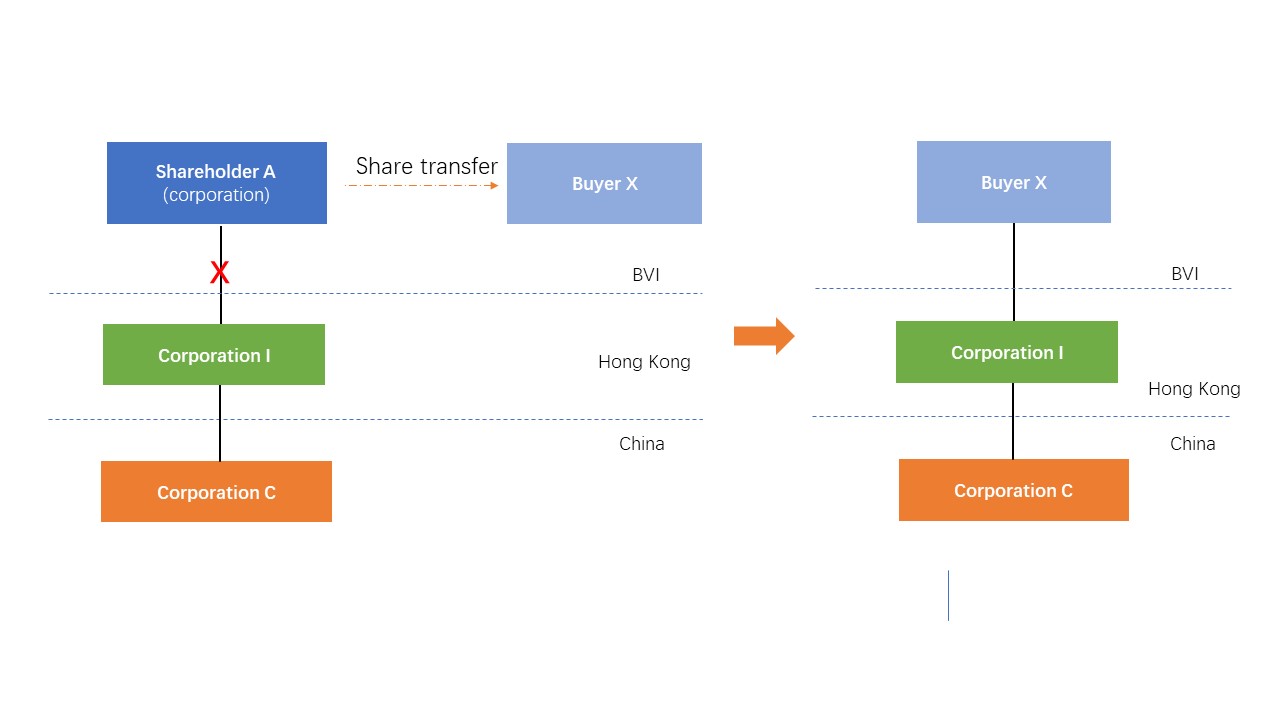

Figure 1 illustrates a two-tiered share ownership structure. In this scenario, nonresident Shareholder A has a “direct” interest in the shares of Corporation I (the intermediate holding company) and has an “indirect” interest in the shares of Corporation C which located in China. When Shareholder A sells its shares in Corporation I to Buyer X, it means Shareholder A also sells its indirect interest in the shares of Corporation C.

Figure 1: Example of offshore indirect share transfer

2. Assessment of a bona fide commercial purpose

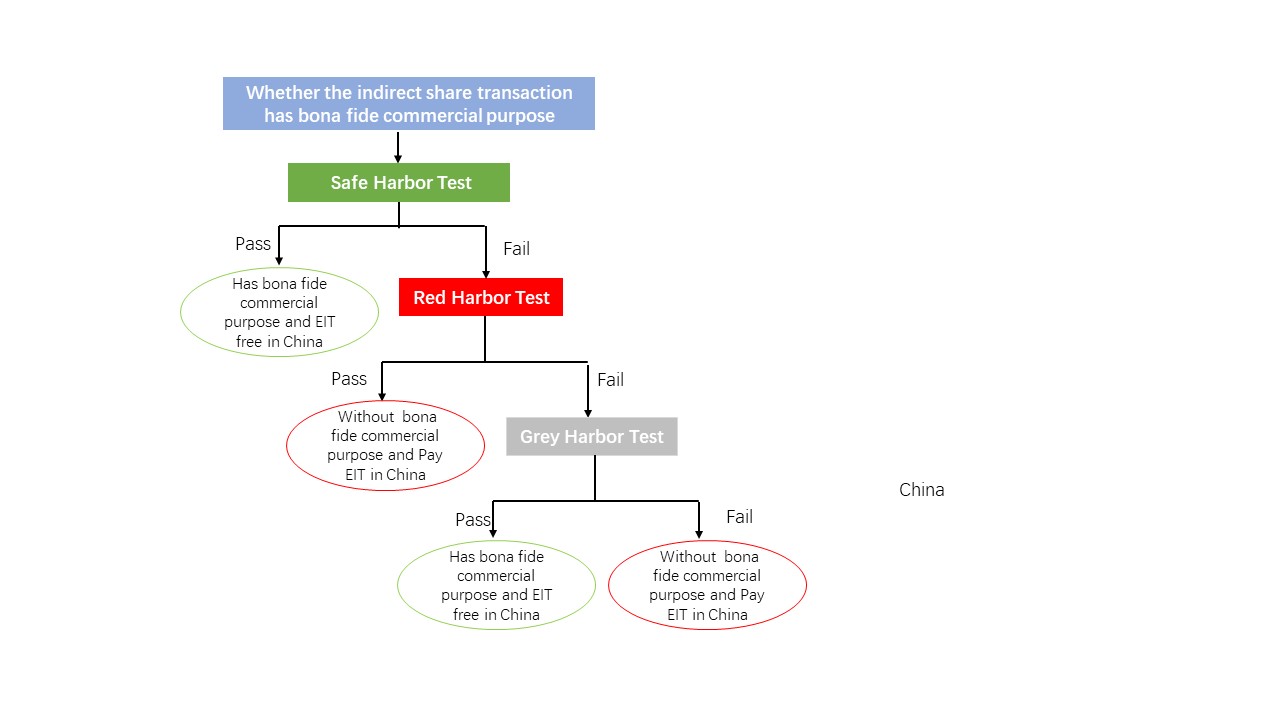

If without a bona fide commercial purpose, an indirect share transfer of Chinese resident companies will be treated as China-sourced income and be subject to 10% withholding tax in China. Figure 2 shows the matrix on how to assess the bona fide commercial purpose.

Figure 2: Assessment of a bona fide commercial purpose

(a) Safe harbor Test

If one of the following conditions can be satisfied, an offshore indirect share transfer shall have sufficient bona fide commercial purpose and be qualified for EIT exemption in China:

Ø Normal buy and sale of shares of the overseas listed company through normal trading on a public stock exchange.

Ø If the nonresident enterprise directly holds and transfers the share of Chinese resident enterprises, the gain derived from the deal would be exempt from EIT under the applicable double tax treaty or arrangement.

Ø Qualifying intra-group reorganizations.

(b) Red Harbor Test

If all the following criteria are satisfied, an offshore indirect share transfer shall be determined to be without bona fide commercial purpose and pay EIT in China:

(1) More than 75% of the equity value of the nonresident enterprise (like Corporation I in Figure 1) is derived directly or indirectly from Chinese resident enterprises (like Corporation C in Figure 1);

(2) More than 90% of the asset value (excluding cash) or the income of the nonresident enterprise is derived from the Chinese resident enterprises during any moment within one-year period prior to the indirect share transfer;

(3) The functions performed and risks assumed by the offshore enterprise and its subsidiaries that directly or indirectly hold shares of the Chinese resident enterprises are limited and insufficient to justify the economic substance of the group structure;

(4) the income tax paid on the indirect share transfer outside China is less than the Chinese income tax if a direct transfer of the Chinese resident enterprises would have taken place.

(c) Grey Harbor Test

In order to determine the existence of a bona fide commercial purpose for the cases neither belong to the Red harbor or Green Harbor, all the facts of an offshore indirect share transfer should be considered and the following criteria should be analyzed on a comprehensive basis:

(1) whether the equity value of the offshore enterprise (like Corporation I) is mainly derived directly or indirectly from Chinese resident enterprises (like Corporation C);

(2) whether the assets or income of the offshore enterprise are mainly derived directly or indirectly from Chinese resident enterprises;

(3) whether the functions performed and risks assumed by the offshore enterprise and its subsidiaries that directly or indirectly hold shares of the Chinese resident enterprises can justify the economic substance of the group structure;

(4) the status of foreign income tax paid on the indirect share transfer;

(5) the status of double tax treaty or arrangement applied to the indirect share transfer;

(6) the duration of the shareholders, business model and the organization structure of the offshore enterprise;

(7) whether the indirect share transfer of Chinese resident enterprises can be replaced by a direct transfer of Chinese resident enterprises.

3. Compliance requirements under Announcement 7

Announcement 7 encourages the buyer and the seller of an indirect share transfer as well as the Chinese resident enterprise to voluntarily report the case to the in-charge tax authority of the Chinese resident enterprise with 30 days after the Sale and Purchase Agreements (“SPA”) signed, including the SPA, equity investment structure, financial statements of the offshore enterprise and its offshore subsidiaries for the last two fiscal years and an explanation letter elaborating on the bona fide commercial purpose of the indirect share transaction.

If the reporting is successfully completed, 5% punitive interest may be waived for seller and the penalty (50% and 300% of the undperaid EIT payable) of failed withholding obligation of the buyer could be waived or receded as well, when the indirect share transfer is deemed to lack sufficient bona fide commercial purpose and needs to pay EIT in China.

4. Our Suggestion

Although the indirect share transaction with sufficient bona fide commercial purpose could be exempted from EIT under Announcement 7, the oversea seller and buyer may have difficulties to determine whether the indirect share transfer has sufficient bona fide commercial purpose or not and to prepare the reporting documents within the 30 days time limit.

Hence, it is suggested that the oversea shareholders should review their China investment structure before an indirect share transfer occurs and assess potential EIT liabilities in relation to Announcement 7. From the buyer side, they should notice their withholding obligations and reflect those obligations into the SPA in order to protect themselves just in case the deal is subject to EIT in China. If both parties agree the indirect share transaction has EIT liabilities in China, then it suggests seller and buyer report the deal to China tax authority together according to announcement 7 in order to waive the said penalties.

PKF Shanghai tax team have helped many clients to complete the announcement 7 reporting in different locations of China. We could assist to assess the EIT liabilities of the indirect share transfer, suggest the reporting strategies and negotiation with in-charge tax authority until the whole process is completed.